What Is an EOB?

Not a Bill—Save Your EOB

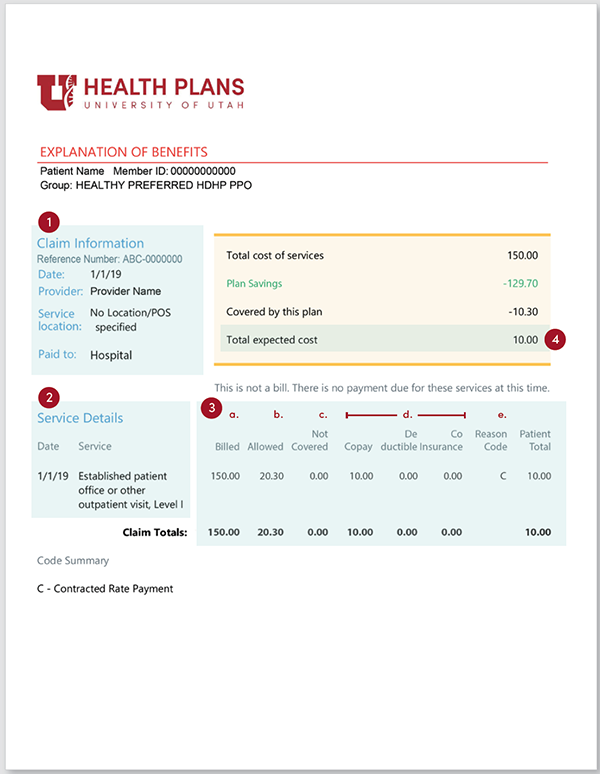

Around the time you receive your patient billing statement, you will also receive an explanation of benefits (EOB) from your insurance provider. An explanation of benefits is a document that explains how your insurance processed the claim for the services you received.

It breaks down the information like this:

- The services we provided

- What the doctor or hospital charged (all charges)

- What your insurance covered and did not cover

- What your insurance agreed to pay

- The amount you must pay (amount you are responsible for)

While this document is not a bill, it is an important tool that shows you how your bill is broken down between the medical service provider(s), your insurance, and you. It can help ensure you are receiving the full benefit or discount that you are entitled to under your insurance plan.

Save your EOB when it comes in the mail! If you need to speak with us about your bill, please have your EOB available.

Information Your EOB Contains

1. The account summary

The summary lists your account information with details like the patient’s name, date/s, and claim number.

2. The claim details

Claim details are a list of the dates we provided the service and a description of the service.

3. The amounts

Amounts:

- charged by the facility or provider;

- the amount your insurance has agreed to pay per their contract with the provider/facility; and

- the difference or discount between what the facility or provider charged and what your insurance paid. (This may also be referred to as an “Adjustment”, “Contracted Agreement”, or “Allowed Amount.”)

Most of the time there will also be a section describing any:

- copays,

- coinsurances, or

- deductibles that have been applied according to your health plan.

Deductibles, Copay, & Coinsurance

Deductible: A deductible is the amount you pay for health care services before your insurance starts to pay anything.

Copay: A copay is a fixed amount you pay for a health care service covered by your insurance. It is typically due before we provide service. Copays are different for different services in the same plan. You may pay a different copay for your primary care than for a specialty service. Emergency care copays are also higher than other copays amounts.

Coinsurance: Based on your insurance benefit, coinsurance is the amount you may be required to pay towards the claim, apart from any copayments or deductible.

Paid by Insurance & Amount You Must Pay

Paid by Insurance

Paid by insurance is the amount of the total charges that insurance is paying towards the claim.

4. Patient responsibility

You may be responsible to pay an amount of the charges/service. This amount is based on your insurance benefits and what the facility and provider charge. The actual billing statement and amount you owe will be sent from the health care facility that provided the service.

How Your EOB Can Help You

Here are some examples of ways to use your EOB and bill to answer questions and identify potential errors.

- Why did you get the bill and what services were covered?

- Why an insurance claim may be denied.

- Are the “in network” versus “out of network” prices listed correctly?

Pay particular attention if your insurance needs additional information from you. If you can provide that as soon as possible to your insurance, they can review it.

Additional Information & EOB Denials

Additional Information on Your EOB

These items aren't on the example EOB here, but may be included in your EOB:

- Amount that may have been paid from spending accounts, such as a health reimbursement account (HRA), if applicable.

- A glossary of the terms and definitions included on your EOB, as well as instructions for how you can appeal a claim, if necessary.

- More specific details about filing an appeal in your state of residence.

- A summary of deductible and out of pocket maximums.

EOB Denials

The billing office can help you understand why your explanation of benefits may have a denial. A denial can happen for several reasons. Below are some of the most common that you will see on an EOB:

- The service you had is not covered by the health insurance plan benefits (also called a non-covered benefit).

- Your insurance coverage was ended (terminated) before you received this service.

- You received the service before you were eligible for insurance coverage (not eligible for coverage).

There may be instances when an insurance carrier denies a claim but will reconsider it if you provide specific information (called “coordination of benefits/COB” information). Some of this information can include:

- Details from an accident,

- Medical records (with pre-existing conditions noted), and/or

- Any additional information the insurance may need.

Your insurance usually requests you to update your coordination of benefits (COB) information annually.

Check Your Medicaid Eligibility

See if You Are Eligible

Medicaid Eligibility Español

Estimate Your Out-Of-Pocket Costs

University of Utah Health has developed a tool that helps you compare and calculate how much you'll pay out-of-pocket for health care services and procedures.

Get a Price Estimate

In accordance with the CMS 2019 IPPS final rule, University of Utah Health has published its list of standard charges and negotiated rates.